AP Invoice Automation Software

Levvel Research research reveals the average cost of manually processing an invoice can be as high as $20, versus $3 for automated Accounts Payable (AP) invoice processing. The payback period for investment in an AP Automation Solution is short, ranging from 6 to 18 months on average.

AP process automation software is a low-risk investment

Accounts Payable Invoice Automation

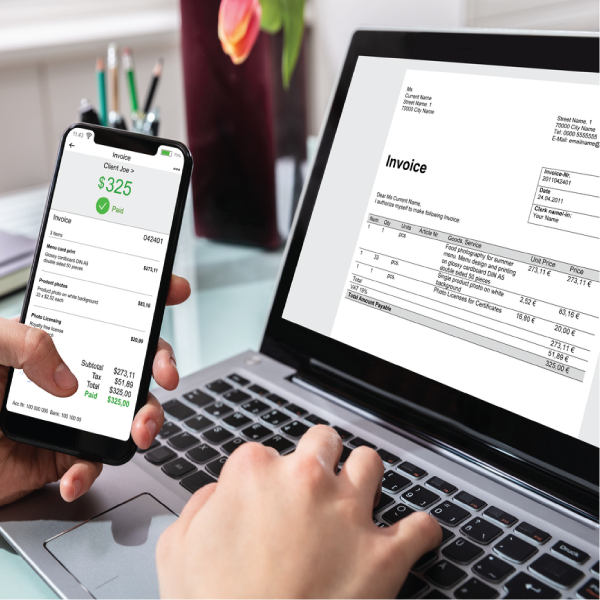

The vast majority of Accounts Payable invoices are still processed by routing paper invoices throughout the organization or scanning and attaching the electronic invoice to an email which is then routed around the organization. Once complete, users in AP then manually key information from the approved paper or email routed invoice into the Corporate ERP/Finance system to then process and pay. Time wasted on paper-driven and manual tasks such as data entry, manual routing, manual follow up, Excel spreadsheet tracking, filing, retrieving, faxing, copying, mailing, and looking for invoices that have been misfiled or lost typically represents more than half of the cost of invoice processing, significantly decreasing productivity levels and increasing the cost per invoice. Investing in AP invoice automation software can result in eliminating some of these processes that slow down productivity.

Call Us: 888-791-9301

Blogs

How Accounts Payable Automation Can Transform Your Business

There’s an old joke in accounts payable departments: The cost of processing a $12 invoice is more than the amount of the invoice itself. If your business is still manually processing invoices, this joke could very well have merit. Manual invoice processing costs can be as high as $20 per invoice, whereas introducing automation brings […]

Where Should You Do Your AP Automation – Outsource or In House?

Businesses of all sizes and across all industries use accounts payable (AP) invoice automation to save time in each stage of their invoice processing. By eliminating paper-driven tasks, such as routing, tracking, retrieving, faxing, and more, businesses improve overall accuracy, efficiency, and visibility with AP automation. Finance departments can reduce labor costs and gain better […]